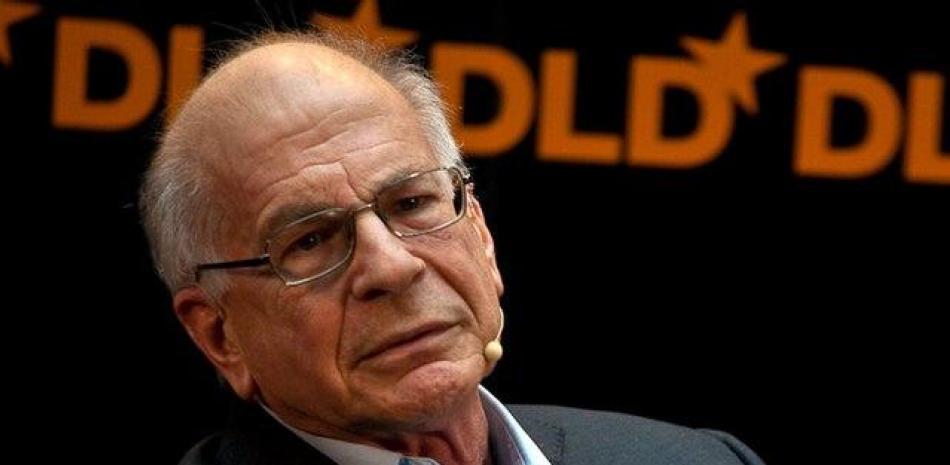

Psychologist Daniel Kahneman, the “grandfather” of behavioral economics, has died

Psychologist, teacher and author Daniel Kahnemanwho won in 2002 Nobel Prize in Economics He died this Wednesday at the age of 90, according to his partner, without studying economics. New York TimesThere is also psychologist Barbara Towersy, who did not indicate the place of her death.

Kahneman (Israel, 1934), who shared the Nobel Prize Vernon SmithIt was significant for showing how humans make decisions, especially under conditions of uncertainty, which can be seen in the event of loss aversion.

A psychologist living in Manhattanused his training as Psychologist to advance what became known as behavioral economics.

His work, which he did mostly during the 1970s, led to a rethinking of issues such as Medical negligence And International Political NegotiationsWhich he analyzed, mainly with Stanford University cognitive psychologist Amos Tversky, with whom he worked for most of his career, according to local media.

their investigation helped establish the field of Behavioral economicswhich applied psychological insights to the study of economic decision-making, but had far-reaching effects beyond academia, The Washington Post noted.

Kahnemanwho spent his childhood in France where his parents arrived in the 1920s, discovered that people depended on him Intellectual Shortcuts that they often lead to wrong decisions that go against their own interests and that those decisions occur because humans are “too influenced by recent events.”

His public belief was largely based on His book ‘Thinking, Fast and Slow‘, which was published in 2011 and was listed in Best Sellers in Science and BusinessIn which he explained his findings in an engaging writing style, using illustrative vignettes that even non-professional readers could interact with, the New York Times noted.

Much of his work is based on the assumption (which he did not originate but organized and advanced) that The mind works in two ways: fast and intuitive (the mental activities we are more or less born with, called System One), or slow and analytical, a more complex system that involves experience and requires effort (System Two), the paper further notes. is

“I am the father of behavioral economics“, he told The Times in 2016 when they interviewed him for this obituary, which the newspaper also highlighted.

Kamenonwho won the Bank of Sweden Prize in Economic Sciences in memory of Alfred Nobel in 2002, has taught at the Hebrew University of Jerusalem, the University of British Columbia, the University of California at Berkeley, and Princeton University.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/EHTQ66PGCD6AYXFGQLUZRIA3GY.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/NMMVCITDFZAHBMTKMDEKCGN244.jpeg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/XIKUPFOUHNGMXDKO7EWEJBEOSA.jpg)