What has changed in 2024 and what is prohibited

Changes to regulated savings accounts in recent months have left some savers confused. So it is necessary to take stock of all the changes made earlier.

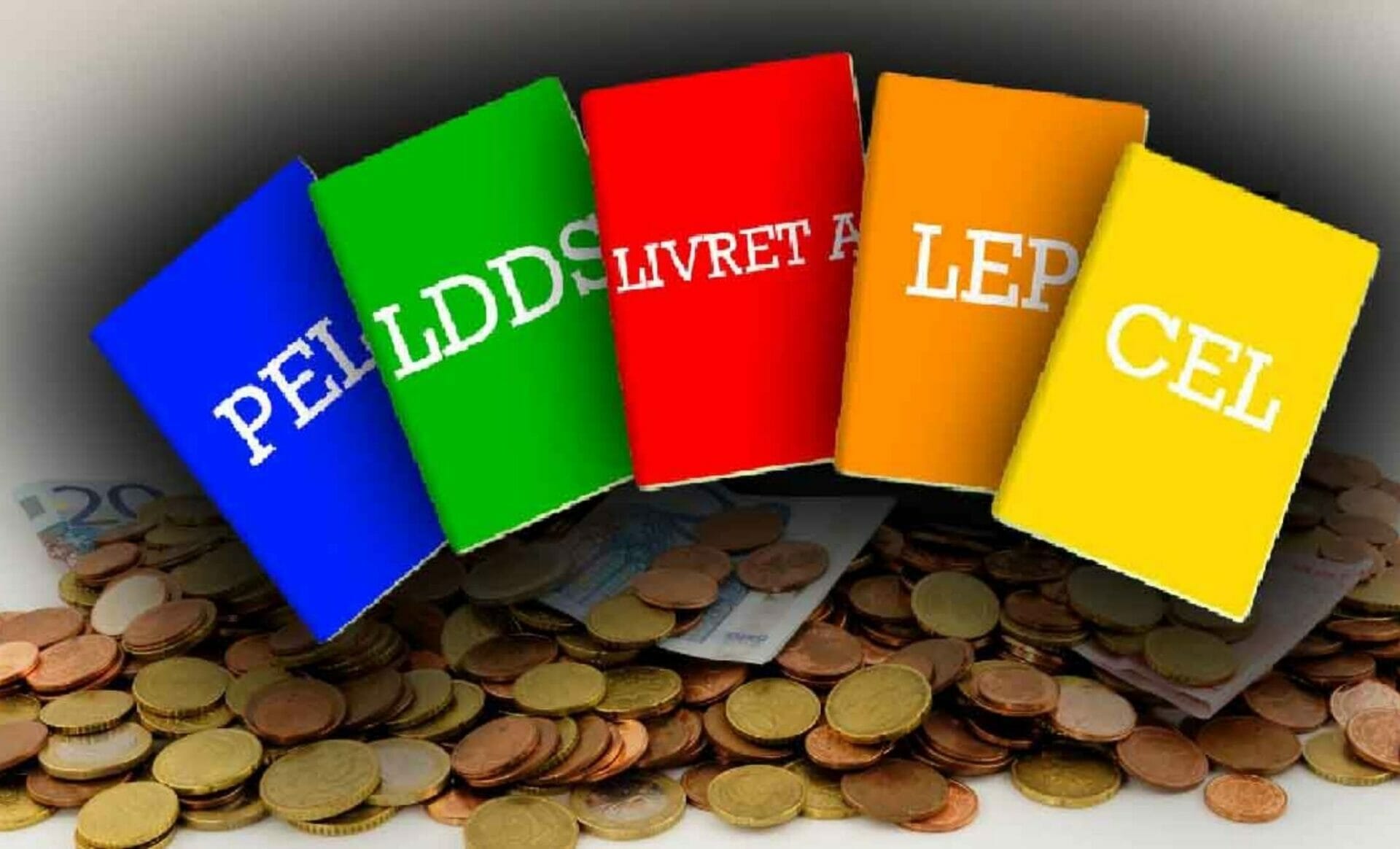

First, it is important to remember that withdrawals or transfers made to withdraw money from a regulated savings account such as Leveret A, LEP or LDDS are authorized only from or to a bank account opened in its name. The owner of the savings account in question. On the other hand, it is no longer mandatory to have a regulated savings account and current account in the same bank.

Indeed, from July 1, 2023 and thanks to the decree of November 10, 2022 and the decree of December 20, 2022, it is completely possible to open a Livret A, a youth savings account or any other savings account. Banks are regulated. Except those with whom the saver has a current account. Moreover, it is entirely possible to close a current account opened with a banking institution by subscribing your savings account with the same bank. Finally, to fund a savings account, transfers must be made only from the saver’s current account.

As a result, it is not possible to get your monthly salary directly into your savings account, explains The voice of the north. Further, transfer from one savings account to another is not possible. This payment should first pass through the current account of the principal concerned.

Furthermore, it is important to remember that holding several of the same savings accounts is strictly prohibited. The government also took steps earlier in the year. Indeed, from January 1, 2024, all regulated savings products are subject to systematic controls while subscribing to the new contract. Taking stock is also important when it comes to the interest rates of different regulated savings accounts.

Various regulated savings account rates in 2024

Because the Popular Savings Account (LEP) rate has increased from 6 to 5% from February 1. For its part, the Livret A rate is maintained at 3% until 2025. There is also a rate. 3% for Credit Mutual Blue Booklet as well as Sustainable and Solidarity Development Booklet (LDDS). For youth passbook, the rate is fixed by the banks. On the other hand, it cannot go below 3%.

Regarding Company Savings Book, its rate will also be maintained at 2.25% this year. On January 1, the Housing Savings Plan increased to 2.25%. Finally, the Housing Savings Account (CEL) remains at 2% again for this year.