Strong rise in the Mexican peso! The dollar fell from 17.00 after US employment data by Investing.com

© Reuters.

Investing.com – The U.S. has turned a corner and is back on track against the dollar, with the exchange rate defying expectations and falling below 16.90 units for the first time this year, after strong labor market data was released in the United States. Cooldown derived from the restrictive monetary policy of the Federal Reserve (Fed).

At approximately 10:00 a.m., Mexico City time, the exchange rate, the dollar to the Mexican peso, fell to 16.88 units. Thus, the national currency showed a significant intraday appreciation of 0.74%, the most significant since mid-December, according to real-time data from Investing.com.

Along with this, the Mexican peso reversed losses recorded earlier in the session, when the US dollar was trading above 17.00 in an environment where financial markets have played down expectations that the Fed may cut rates first. Interest rates at the beginning of March.

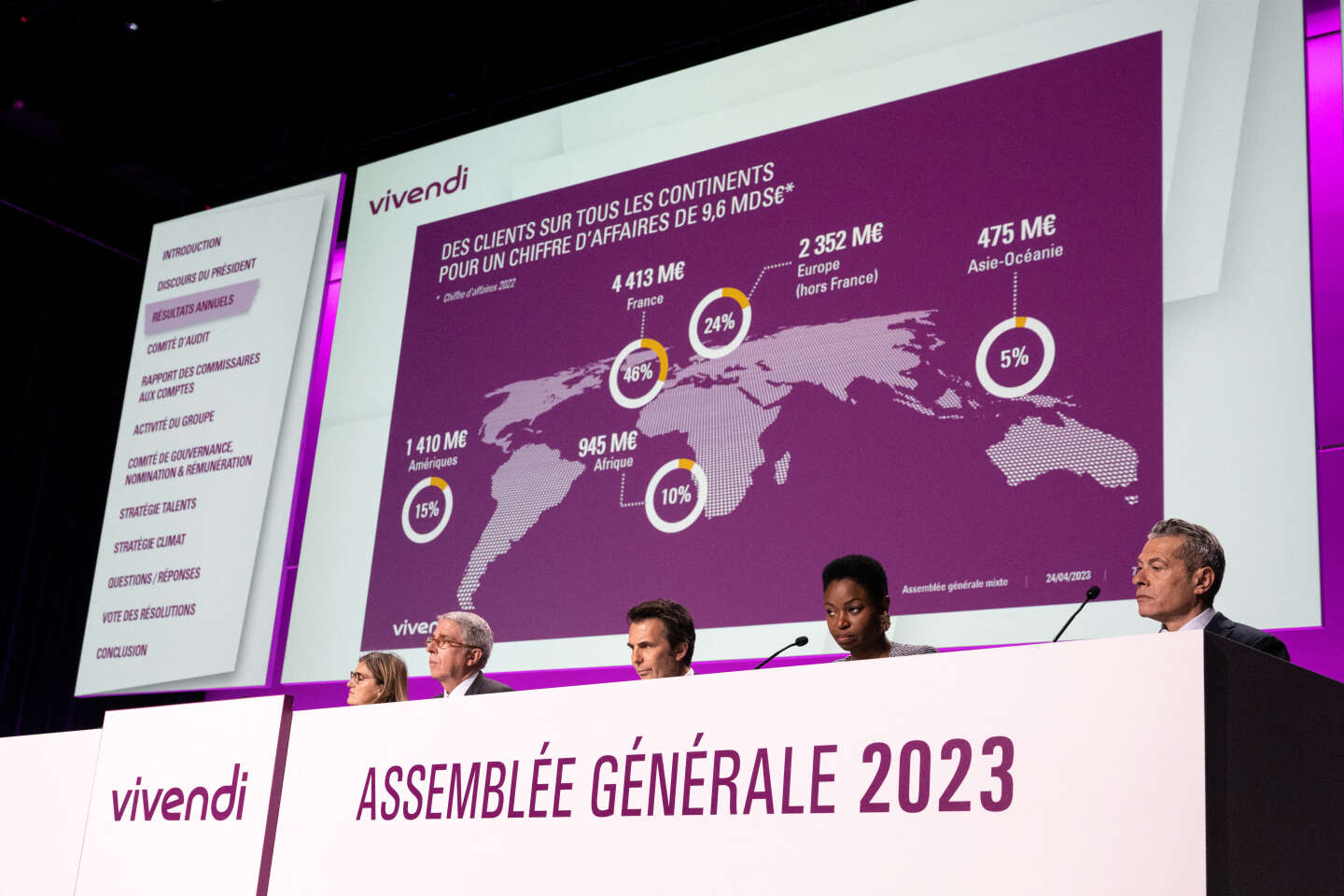

Source: Investing.com

Rate cuts are coming! Get ahead of investment opportunities with InvestingPro. Take advantage of this great New Year offer! InvestingPro+ Half Price +Additional discounts In 1 year plan with code 2024soypro1Or on your 2-year subscription with a coupon 2024soypro2. Click here and don’t forget to add the discount code!

Why Mexican Peso Rises with US Employment Data?

It was announced this morning that in December, the US economy generated 216,000 non-farm payrolls, a higher figure than the previous month and well above the 170,000 expected by economists consulted by Investing.com, after all Accelerates against predictions. up from 173,000 observed in November (revised from 199,000 previously reported).

In terms of private non-farm payrolls, 164,000 were created in December, a higher-than-estimated figure, while the unemployment rate remained at 3.7%, contrary to expectations that it would rise by a tenth.

“The appreciation of the peso is due to the release of the December employment report in the United States, which was better than expected. The above is positive news for Mexico’s economic development due to the close economic ties between the two countries through exports,” said Gabriela Siler Pagaza, director of economic and financial analysis at Grupo Financiero Base.

This data has also generated volatility in , which tracks the evolution of this currency in a basket of six other major currencies. The dollar breached the 103-point mark, its highest level since mid-December, after reporting strength in job creation.

“The solid employment report led operators to revise their forecasts of an early and significant interest rate cut by the Federal Reserve through 2024,” said Jeanneth Queiroz Zamora, director of economic, exchange and stock market analysis at Grupo Monex Financial.

However, at the time of writing, the dollar was down 0.31% and below the level seen earlier in the session at 102.10 units.

“As various employment data released during the week already show, the labor market remains strong and shows signs of weakening, wage increases may generate additional inflationary pressures,” noted Jorge Gordillo Arias, director of economic and stock market analysis. . At CIBanco.

Thanks to the momentum recorded this morning, the Mexican peso has returned to the levels recorded in the last sessions of December and plans to close the first week of 2024 with an appreciation of about 0.4%.