Renault says no to stock exchange for Ampere, a sign that the Tesla model no longer works

The IPO of Diamond brand Ampere, its electric car and new mobility solutions subsidiary, was scheduled to take place in the first half of 2024. The cancellation reflects the recent reluctance of producers towards financial markets.

Tesla’s rise in the stock market, in recent years, has allowed it to access the necessary capital to enable it to continue investing and lower the cost of its models. A strategy that has driven many startups in the sector to make their presence felt in the stock markets at all costs, even if they are not yet profitable or have not yet started mass production of cars.

At Renault, with its new electric car subsidiary Ampere, the brand wanted to build a good stock market image and capitalize on market growth to reassure investors. An aspirational recovery finally took place in 2024, when market conditions did not resemble the confinement years in late 2023 or a recovery in tech stocks. At a conference, its boss Luca Di Maio confirmed the cancellation of the IPO. And hinted that Renault would take care of the financing.

“I said cancel”Renault’s CEO, along with its financial director Thierry Peyton, made the announcement during an online event on Monday evening. “The state of the stock market and the cash flow generated in recent months have led us to this decision”, he added. If it is true that profitability has increased on sales of every car manufacturer that has launched electric vehicles, it is also fair to admit that market conditions have deteriorated.

The announcement, which could have been received as a failure, was instead welcomed by investors as Renault shares fluctuated between 2 and 3% after the close on Monday evening.

The end of the Tesla model

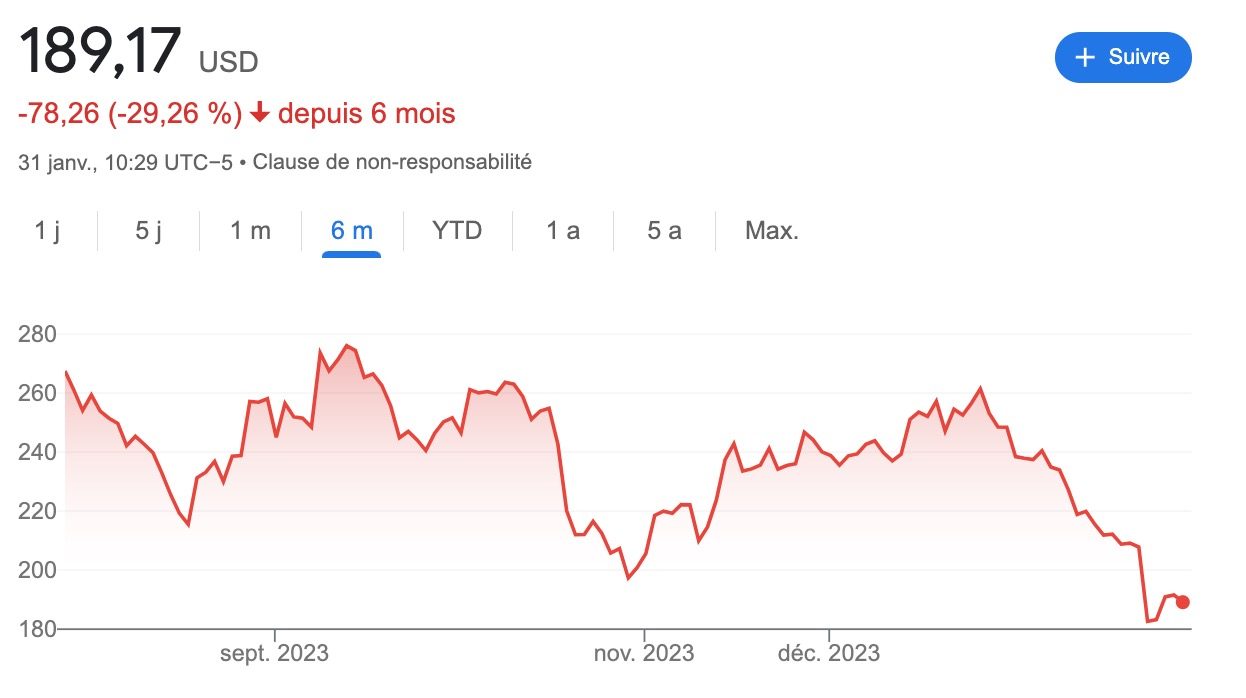

The model of stock market success that is Tesla illustrates the situation well. Since its 2021 high, the stock has fallen more than 53%. In the last six months, its capitalization has fallen by 29% to $592 billion, despite the fact that the American manufacturer has managed to be competitive in price, reach its highest production level and offer the first successful iteration of its Model 3.

A close performance by Porsche, which lost 28% in the stock market in six months, despite recent announcements of models such as its new 100% electric Macan. Within the Volkswagen Group, distinguishing Porsche from the group’s other brands in independent action was also seen as a desire to capitalize on independent action from the group’s brakes which did not only produce Ultra models. – Profitable.

© Google Stock Market

© Google Stock Market

Electric? A “non-bearing” market for the moment

For Luca di Meo, the current situation for electric cars in the stock market is not just the coming of age and the end of double-digit growth. The man was more serious and then described the market “Not carrying at this moment”. Despite having seven models in the pipeline, including an autonomy of more than 600 kilometers, a new cheap Renault 5 and a rather accessible electric Scenic, including a Twingo priced at less than 20,000 euros, we have to wait to hope to be able to highlight an activity. New dynamics and software solutions in capital markets.

To avoid the cold rain and regain investor confidence, Renault bosses still called 2023 the best year in 10 years (with more than 10.5 million registrations in Europe). what “Self-Financing Sustainable”. See you on February 15 to find out more with the release of the group’s annual results. An important event also since Renault will no longer include Nissan, which left the alliance in September 2023, and which was originally to be integrated into the Ampere project.

🔴 To not miss any news from 01net, follow us on Google News and WhatsApp.